Category Archives: Uncategorized

Wealthy Max Arranges Events in Hong Kong to Fight Civil Forfeiture Case Challenges Members of Congress and Other Government Officials to See for Themselves if the Company is Guilty

Feb. 9, 2016 – PRLog — Washington, DC – Wealthy Max Limited (Wealthy Max), a claimant in a federal civil forfeiture case involving supposedly counterfeit coins, today announced that it had invited the members of the House Financial Services Subcommittee on Domestic Monetary Policy and Technology as well as senior officials from the Departments of Treasury, Justice and Homeland Security, to attend a briefing and product audit in Hong Kong. The event is being held as part of the Company’s fight against the civil forfeiture of $2.388 million owed to it by the U.S. Mint. It will also demonstrate once and for all that Wealthy Max does not traffic in counterfeit U.S. coins.

On February 23rd there will be a briefing by Wealthy Max executives and a public unsealing of 13 metric tons of damaged U.S. coins that were destined to be shipped to the U.S. Mint until the civil fortitude caused a halt to operations. The unsealing will be overseen by former U.S. FBI agents who are members of the FormerFedsGroup.com.

On February 24th Wealthy Max will organize a trip to Foshan, China, to visit metal recycling companies where the Company sources its coins. Participants will see the hand-sorting process that yields damaged U.S. coins, as well as the growing stockpiles of coins that would have been returned to the U.S. Mint, but for this unjust civil forfeiture action.

“The members of the House Financial Services Subcommittee on Domestic Monetary Policy and Technology have oversight responsibility for the U.S. Mint, and should have a keen interest in this case, as it reflects unprecedented executive branch over reach, which could impact perceptions of the government’s commitment to full faith and credit in our currency,” said Bradford L. Geyer, counsel for Wealthy Max. “Going back to the founding documents of our country, the Secretary of the Mint, with Congressional oversight, has the sole responsibility for the minting of coins and sourcing materials to be used in those coins. The actions of the U.S. Attorney’s Office and the Department of Homeland Security have effectively usurped this responsibility.”

“Wealthy Max has been a reliable supplier to the U.S. Mint for over a decade and we have successfully redeemed more than 160 shipments of coins in that time,” said Matthew Wong, director, Wealthy Max Limited. “We were shocked by the accusations against us, and the unjust seizure of our property by the U.S. government. We have been treated like criminals who have no rights. This is why we are demanding our property back, and more, we are demanding justice for ourselves and others who have been wronged by the U.S. authorities. Before these officials accuse us of being criminals, they should come to Hong Kong to see for themselves our product and our supply chain.”

In addition to the members of congress and their staffs, and the other U.S. government officials who have been invited to this event, Wealthy Max has extended invitations to local and international media, and members of the American Chamber of Commerce in Hong Kong.

Volume Of Commerce Problems In Antitrust Sentencing

Problems With Volume Of Commerce In Antitrust Sentencing

By Robert E. Connolly and Joan E. Marshall

Law360, New York (September 15, 2014, 10:28 AM ET)

The recent sentencing of Mathew Martoma for insider trading focused the debate over the severity of white collar crime sentences driven by mechanical calculations in the federal sentencing guidelines. The probation department had recommended 20 years in jail based on the fraud guidelines profit calculations. Martoma was sentenced on Sept. 8 to nine years in prison.[1] Last month the U.S. Sentencing Commission, which sets the federal guidelines, announced it was considering changes to its policies on white collar sentences, specifically addressing the issue of profit and considering whether “there are ways the economic crime guidelines could work better.”[2] While profit is certainly a factor in sentencing, the steep and severe sentences based on profit calculations are under question.

____________________________________________________________________

Subscribe to Connolly’s Cartel Capers Blog Here

____________________________________________________________________

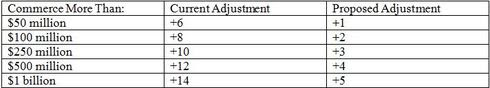

Even more questionable, however, is the antitrust sentencing guideline U.S.S.G §2R1.1, where individual jail sentences are swiftly driven upward to the Sherman Act 10-year maximum, not by any defendant’s personal profit, but by the volume of commerce.[3] The volume of commerce is the most significant upward adjustment and can more than double the base offense level of 12. The relationship between volume of commerce and culpability is at best tenuous. The weight placed on the volume of commerce in calculating prison sentences has led to great uncertainty, departures by judges in contested sentences, and routine departures by the Antitrust Division in plea agreements.

In this article, we look at the defects in using volume of commerce as a significant component of determining prison sentences for individual antitrust defendants. We also recommend reforms that would insert more meaningful measures of culpability into the sentencing process.

The Guidelines Volume of Commerce Is Not a Reasonable Measure of Individual Culpability

Due to the weight given volume of commerce, a defendant with no prior criminal history in an international antitrust cartel can find himself close to 10-year Sherman Act maximum regardless of his role in the offense. The volume of commerce can add up to 16 levels to the base offense level of 12. An offense level of 28 results in a guidelines calculation of 78-97 months in prison before any other adjustments. While Congress did raise the Sherman Act maximum to 10 years, maximums are only appropriate when there are aggravating circumstances — not for a typical, but large cartel. While unintentional, in practice the guidelines harshly punish foreign executives since the most severe penalties are reserved for international cartels with large volumes of commerce.

There is little correlation between the volume of commerce in a cartel and individual culpability. For example, an owner of a concrete company that rigs bids on $5 million worth of contracts on public projects and personally pockets the conspiratorial overcharge is more culpable than a lower level employee in a $1 billion international cartel that is ordered to attend cartel meetings. Yet, the concrete company owner would get a two-level upward adjustment resulting in a guidelines range of 18 to 24 months while the lower level employee in the international cartel would get a 14-level adjustment and be facing close to the Sherman Act maximum of 10 years. These are not extreme hypotheticals — they are essentially the guidelines results in United States v. VandeBrake[4] and United States v.AU Optronics.[5]

In VandeBrake the court departed upward from the guidelines and imposed a four-year sentence on the concrete company owner. In AU Optronics several lower level executives were acquitted, but even the president and vice president received downward departures to sentences of three years. When rejecting the government’s 10-year guideline prison recommendation in AU Optronics, the court said, “The defendants thought they were doing the right thing vis-a-vis their industry and their companies. They weren’t, but that’s what they thought at the time.”[6]

On the other hand, the judge in VandeBrake found the defendant was motivated by greed. The commentary to the antitrust guidelines states: “The offense levels are not based directly on damage caused or profit made by the defendant because damages are difficult and time consuming to establish.”[7] While a blunt proxy like volume of commerce may be suitable for assessing a corporate fine, when individual liberty is at stake, more relevant culpability factors are needed.

There is another major flaw in the application of the volume-of-commerce adjustment to individual sentences. Under U.S.S.G. §2R1.1 (b)(2), “the volume of commerce attributable to an individual participant in a conspiracy is the volume of commerce done by him or his principal in goods and services that were affected by the violation.” This means that if the CEO of Company A decides to form or join a cartel and at the same time directs his sales manager to coordinate price and volume data with competitors, both are tagged with the same volume of commerce. This isn’t right.

There used to be a principle of big fish/little fish by which prosecutors and courts differentiated between the role a person played in the offense, including seniority, motivation for, and benefit received from the crime. Cartel members themselves make this distinction, often referring to cartel meetings as “top guy” or “working group guy” meetings. But, the volume-of-commerce adjustment contains no such distinction. The guidelines do provide for a mitigating role in the offense adjustment, but in an antitrust case, this makes only a slight difference in the recommended guidelines range.[8]

There are two other drawbacks with using the volume of commerce to determine an individual’s jail sentence. First, the volume of commerce is usually determined through very lengthy and complex negotiations between the Antitrust Division and the corporate defendant. The negotiations cover variables such as the duration of the conspiracy, the geographic scope of the conspiracy, the products involved and the customers affected.[9] An individual defendant is often later sentenced using a volume of commerce he had no input in calculating and insufficient resources to challenge. Finally, courts have taken an expansive view of what commerce should be included in the guidelines calculation. Courts have uniformly held that all sales made by a defendant corporation during the price fixing conspiracy should be presumed affected by the conspiracy.[10]

Some Suggestions for Reform

1. Reserve the Sherman Act Maximum for Egregious Cases

The maximum prison sentence of 10 years under the Sherman Act should be reserved for the most egregious cases.[11] These cases would include aggravating factors such as recidivism, economic coercion of competitors or subordinates to join the cartel, or extraordinary steps to prevent detection or reporting of the cartel.

2. Increase the Base Offense Level

Rather than adjust the offense level dramatically based on volume of commerce, we suggest that the base offense level be raised to a level 17 with a resulting sentencing range of 24-30 months. This captures the philosophy that short but certain jail sentences are crucial to deterring antitrust crimes — with “short” being redefined in light of the increase in the Sherman Act maximum to 10 years in jail. The recommended guidelines prison sentences should begin within this range, but allow for more culpable senior executives to face longer jail sentences based on enhancements.

3. Eliminate Volume of Commerce Except for the Most Senior Member of the Conspiracy

If the volume of commerce has a relationship to culpability, it should be limited to the senior executive responsible for engaging the company in a cartel. Even here, however, we would limit the extreme sentences for large international cartels by lowering the upward adjustment for individuals.

While not related to volume of commerce, we propose eliminating the aggravating-role adjustment for the number of participants in the offense. U.S.S.G. §3B1.1 provides for an up to four level enhancement if the conspiracy involved five or more participants. There should be no enhancement based on the number of participants in the cartel. It is simply double counting. By their very nature, price fixing cartels involve numerous participants. Participants in smaller antitrust cartels are not more or less culpable than individuals in larger industries.

5. New Enhancements Should Be Added to the Guidelines Based on Individual Characteristics

To compensate for eliminating or reducing the role of the volume of commerce adjustment, the base offense level could be increased by a rage of one to four levels if the court finds that the defendant was motived by personal gain in the form of increased salary, bonuses or stock options. There is no difference in liability if an agreement was reached to try to prevent layoffs in a distressed industry, as opposed to increasing prices to boost stock options or pay, but there is a difference in culpability.

Courts will consider these factors whether they are mentioned in the guidelines or not, so to maintain some consistency, some sentencing discretion should be added based on these factors. Other personal characteristics, such as whether the defendant helped initiate the cartel or ordered subordinates to participate, are also relevant to culpability and should be taken into account by the guidelines.

6. Add an Enhancement for Failure to Have an Effective Antitrust and Ethics Compliance Program

While not related to the volume of commerce, we suggest a revision to encourage strong and effective ethics and compliance programs. The Sentencing Commission should consider enhanced punishment for any individual defendant who was in a leadership position and failed to implement a compliance program as set forth in the Sentencing Guidelines. U.S.S.G. §8B2.1(b) lists the seven factors that must exist for a compliance and ethics program to be considered “effective.” A senior executive who had the authority to implement, or at least advocate for an antitrust compliance program (typically c-suite executives) and failed to do so is more culpable than an executive who violated a compliance program. These executives fail to give their subordinates the training they need to identify and resist involvement in the criminal activity and fail to inform them of the “whistleblower” mechanisms available to stop the activity.

This proposal is based on our collective experience in sitting across the table from lower level foreign executives who have only a vague notion about the U.S. antitrust laws and do not have an appreciation for the consequences of what they are being told to do by their superiors. Antitrust and ethics training can reduce the incidence of these scenarios.

These Suggested Reforms Will Benefit Antitrust Enforcement

These reforms are not suggested to go “soft” on criminal antitrust offenders. As former career Antitrust Division prosecutors, we have urged courts to imprison convicted antitrust defendants. We don’t presume to have all the answers on antitrust guidelines reform, but we think we have identified the most pressing issue. As the Sentencing Commission reviews the antitrust guidelines, we urge that consideration be given to reforming the way volume of commerce escalates an individual’s recommended prison guidelines range.[12] When an individual’s liberty is at stake, it is important to get it right.

—By Robert E. Connolly and Joan E. Marshall, GeyerGorey LLP

Robert Connolly is a partner in the Washington, D.C., office of GeyerGorey and former chief of the Middle Atlantic Field Office of the U.S. Department of Justice Antitrust Division. His blog, Cartel Capers, covers price-fixing, bid-rigging and market-allocation issues. Joan Marshall is a partner in the firm’s Dallas office and a former trial attorney for the Antitrust Division.

The opinions expressed are those of the author(s) and do not necessarily reflect the views of the firm, its clients, or Portfolio Media Inc., or any of its or their respective affiliates. This article is for general information purposes and is not intended to be and should not be taken as legal advice.

[1] See http://www.law360.com/

[2] See Christopher Matthews, September 7, 2014, at http://online.wsj.com/

[3] “For purposes of this guideline, the volume of commerce attributable to an individual participant in a conspiracy is the volume of commerce done by him or his principal in goods or services that were affected by the violation.” U.S.S.G §2R1.1 (b) (2).

[4] United States. v. VandeBrake, 771 F. Supp. 2d 961 (N.D. Iowa 2011).

[5] United States v. AU Optronics Corp. et al., CR-09-0110 (SI)(filed June 10, 2010).

[6] United States v. AU Optronics Corporation, CR-09-0110 (N.D. Cal. Sept 20, 2012)(sentencing hearing).

[7] U.S.S.G. §2R1.1 application note 3.

[8] See Mark Rosman and Jeff VanHooreweghe, Antitrust Source, August 2012 “What Goes Up Doesn’t Come Down: The Absence of The Mitigating Role Adjustment In Antitrust Sentencing, available at: http://www.wsgr.com/

[9] The many variables subject to negotiation are outlined in the Antitrust Division’s Model Plea Agreement. See Antitrust Division Model Annotated Corporate Plea Agreement, available at: http://www.justice.gov/atr/

[10] See e.g., United States v. Andreas, 216 F.3d 645, 678 (7th Cir. 2000); United States v. Hayter Oil. Co, 51 F.3d 1265, 1273 (6th Cir. 1995).

[11] Although Congress raised the Sherman Act maximum prison sentence to ten years to indicate the seriousness of antitrust offenses, it is still true that some offenses are more egregious than others and the maximum penalty should be reserved for such cases.

[12] For a more detailed look at suggested reforms to the antitrust guidelines for sentencing individuals, see Letter of Robert E. Connolly to the Sentencing Commission, July 29, 2014 available at http://papers.ssrn.com/sol3/

Connolly’s Cartel Capers: Upcoming ABA Program: Rigging Bids on the Courthouse Steps- Real Estate

Upcoming ABA Program: Riggings Bids on the Courthouse Steps: Real Estate

My partner, Allen Grunes, will be the moderator for this ABA teleconference on July 16, 2014 beginning at noon. Mr. Grunes is a former Antitrust Division prosecutor and the panel will include Niall Lynch, Latham & Watkins, San Francisco, CA; Michael Tubach, O’Melveny & Myers, San Francisco, CA; and Wendy Waszmer, King & Spalding, New York, NY. The session will cover the DOJ’s recent real estate foreclosure and municipal tax lien auction bid rigging prosecutions. Several cases allege not only antitrust but also fraud and other criminal statute violations. These excellent panelists, including former prosecutors, will discuss some of the unique features of these cases, DOJ’s enforcement message, and what to expect next. To tune in, register here

[Read Remainder of Blog Post here…]

Connolly’s Cartel Capers: Fugitive’s Return to U.S. Upon Indictment Admissible to Show “Consciousness of Innocence”

Fugitive’s Return to U.S. Upon Indictment Admissible to Show “Consciousness of Innocence”

Cartel Capers

Robert E. Connolly

We are all familiar with the doctrine of “consciousness of guilt” wherein the prosecutor may introduce evidence such as flight or cover-up that permits an inference that the defendant believed he was guilty. But, there is also a less well-known and less widely accepted doctrine of “consciousness of innocence.”

I wanted to report on a pretrial victory by Daniel M. Gitner of Lankler Siffert & Wohl LLP related to “consciousness of innocence” evidence. Mr. Gitner represents Rengan Rajaratnam, the younger brother of Raj Rajaratnam, who was indicted on charges of insider trading and is awaiting trial. US. v. Rengan Rajaratnam, No. 1-13-cr-00211 (S.D.N.Y June 6, 2014). In a pretrial motion, U.S. District Judge Naomi Reice Buchwald ruled that she would allow Rajaratnam to introduce “consciousness of innocence” evidence during his upcoming trial. The judge will allow jurors to hear about Rengan’s decision to fly from Brazil to the U.S. shortly after being indicted in March 2013. The defense argues that this evidence shows Rengan knew he was innocent.

* * * *

For the Rest of the Story…Click Here

House Republicans Say Comcast Merger Risks Undue Sway on Channels

House Republicans Say Comcast Merger Risks Undue Sway on Channels

New Your Times

“Allen P. Grunes, a partner at GeyerGorey and a former Justice Department antitrust lawyer, said Comcast and Time Warner do compete in the sale of local cable advertising, which takes up two to three minutes of every hour of cable programming.

“If the merger is consummated, the merged firm would likely have the power to increase prices in the spot cable advertising market through its control over a large number of subscribers and key market gateways,” Mr. Grunes said.”

“Karl Lee” Charged for Evading US Sanctions

Sanctions Previously Had Been Imposed Because of “Karl Lee’s” Role in Iranian Weapons Proliferation Activities; an Additional Round of Sanctions Are Also Announced Today

Li Fangwei, who is more commonly known by his alias “Karl Lee,” is charged with violating the International Emergency Economic Powers Act (IEEPA) by using United States-based financial institutions to engage in millions of dollars of U.S. dollar transactions in violation of economic sanctions that prohibited such financial transactions. In addition, Li Fangwei is also charged with conspiring to commit wire fraud and bank fraud, a money laundering conspiracy, two separate violations of IEEPA and two separate substantive counts of wire fraud, in connection with such illicit transactions. Li Fangwei, a national of the People’s Republic of China, is a fugitive.

The announcement was made today by Assistant Attorney General John P. Carlin of the Justice Department’s National Security Division, Preet Bharara, U.S. Attorney for the Southern District of New York, George C. Venizelos, Assistant Director in Charge for the FBI’s New York Field Office.

“ These charges are an important part of the ‘ all tools’ approach our government is takingagainst Li Fangwei to shut down and deny him the profit from his proliferation activities,” said Assistant Attorney General Carlin. “This case is an outstanding example of multiple agencies working together to focus various enforcement efforts on the significant threat to our national security posed by such proliferation networks.”

“As alleged, Li Fangwei has used subterfuge and deceit to continue to evade U.S. sanctions that had been imposed because of his illicit trade in prohibited materials with Iran,” said U.S. Attorney Bharara. “Previously having been exposed as a violator of those sanctions, Li spun a web of front companies to carry out prohibited transactions essentially in disguise. He now stands charged with serious crimes, and millions of his dollars have been seized. It is the hope of this Office not only that Li’s banned commerce cease once and for all, but that he be apprehended and brought before the bar of American justice.”

“Whether motivated by greed or otherwise, Li Fangwei allegedly ignored sanctions imposed by the United States Government and hid behind front companies he developed to engage in a series of illegal transactions, including attempts to acquire ‘dual use’ items on behalf of Iran-based entities,” said Director in Charge Venizelos. “IEEPA makes it a crime to willfully violate U.S. sanctions on designated countries such as Iran. Individuals and companies who evade U.S. sanctions and misuse our banking system to further their illegal activity not only undermine the integrity of our financial markets but also threaten U.S. National Security interests. The FBI is committed to ensuring that strategically important goods and technology, particularly those that could be used in the production or delivery of weapons of mass destruction, do not end up in the wrong hands.”

According to the superseding indictment previously filed in Manhattan federal court and other court documents:

Li Fangwei controls a large network of industrial companies based in eastern China, one of which is LIMMT Economic and Trade Company Ltd. (LIMMT). Over the years, Li Fangwei’s companies have done millions of dollars of business with Iran. This business has included selling to Iranian entities various metallurgical goods and related components that are banned for transfer to Iran by, among others, the United Nations, because the items are controlled by the Nuclear Supplier’s Group (a multinational group that maintains “control lists,” which identify nuclear-related dual-use equipment, material and technology). Li Fangwei has been, among other things, a long-time supplier to Iran’s Defense Industries Organization and Iran’s Aerospace Industries Organization. In addition, Li Fangwei has been a principal contributor to Iran’s ballistic missile program, through China-based entities that have been sanctioned by the United States.

In light of his supply of restricted items to Iran, the United States has imposed targeted sanctions on both Li Fangwei and LIMMT. Specifically, the United States Department of the Treasury’s Office of Foreign Asset Controls (OFAC) publicly added LIMMT (in 2006) and Li Fangwei (in 2009) to its List of Specially Designated Nationals and Blocked Persons (SDN List). By virtue of their inclusion on the SDN List, Li Fangwei and LIMMT were effectively precluded from conducting any business within the United States without first obtaining a license or authorization from OFAC. Neither Li Fangwei nor LIMMT has sought such a license or authorization.

The above-referenced restrictions have forced Li Fangwei to operate much of his business covertly. In response to United States sanctions, Li Fangwei has built an outsized network of China-based front companies to conceal his continuing participation, and LIMMT’s continuing participation, in sanctioned activities. The front companies are listed in Exhibit A to the superseding indictment. As shown in Exhibit A, many of those front companies have used the same address as LIMMT, or a close variant thereof.

During the period from 2006 through to the present, Li Fangwei has used front companies to engage in more than 165 separate U.S. dollar transactions, with a total value in excess of approximately $8.5 million dollars. Included in those illicit transactions have been transactions involving sales to U.S. companies and sales of merchandise by Li Fangwei to Iran-based companies utilizing the U.S. financial system. Li Fangwei also attempted to acquire on behalf of Iran-based entities so-called “dual use” items from the United States, China and other countries that could be used in the production of weapons of mass destruction and/or devices used to deliver weapons of mass destruction.

Additionally, the U.S. Attorney’s Office and the FBI announced the seizure of over $6,895,000 in funds attributable to the Li Fangwei front companies, and the filing of a civil complaint seeking the forfeiture of those funds to the United States. The seized funds are substitutes for money held by Li Fangwei’s front companies at banks in China, and were seized from accounts at U.S. banks held in the name of foreign banks used by these front companies to conduct U.S. currency transactions (the correspondent accounts). The funds were seized pursuant to seizure warrants issued on Dec. 18, 2013, and April 25, 2014. The $6,895,000 represents funds used by the Li Fangwei front companies to engage in transactions that violate the U.S. sanctions laws and thus are subject to forfeiture. There are no allegations of wrongdoing by the U.S. or foreign banks that maintain these accounts. Because the funds used in those transactions are held in banks overseas, the United States is unable to seize the funds directly. However, pursuant to U.S. law, the United States can seize funds located in a bank’s correspondent accounts in the United States if there is probable cause to believe that funds subject to forfeiture are on deposit with that bank overseas. Based on this provision and others, the seizure warrants were executed. These funds were transferred to a seized asset account maintained by the United States Marshals Service pending resolution of the forfeiture action.

Based on information developed in the course of the FBI’s investigation into Li Fangwei that forms the basis of the superseding indictment, OFAC today is adding eight additional front companies used by Li Fangwei to its List of Specially Designated Nationals and Blocked Persons.

Finally, the United States Department of Commerce announced today the addition of nine China-based suppliers of Li Fangwei to its Entity List.

The Superseding Indictment charges Li Fangwei with seven separate offenses:

- Count One: Conspiracy to violate the International Emergency Economic Powers Act;

- Counts Two and Three: Substantive violations of the International Emergency Economic Powers Act;

- Count Four: Money laundering conspiracy;

- Count Five: Conspiracy to commit wire fraud and bank fraud; and

- Counts Six and Seven: Wire fraud.

If convicted, Li Fangwei faces a maximum sentence of 20 years in prison on each of Counts One through Four and Counts Six and Seven, and 30 years in prison on Count Five. The statutory maximum sentences are prescribed by Congress and are provided here for informational purposes only, as any sentencing of the defendant would be determined by the judge.

Additional efforts directed at Li Fangwei and his network were announced today by the U.S. Department of State’s Transnational Organized Crime Rewards Program, Department of Treasury and the Department of Commerce.

The charges contained in the indictment are merely accusations and the defendant is presumed innocent unless and until proven guilty.

GeyerGorey LLP’s Grunes and Stucke in Roll Call: Another ‘Too Big to Fail’ Merger From Comcast’s Playbook

“Last week, the Senate Judiciary Committee held the first hearing to examine the merger of the nation’s top two cable operators, Comcast and Time Warner Cable. But the merger no longer has the air of inevitability it once did. What happened?

People who are studying this merger do not like what they see for many reasons. Here are three: less innovation, greater market power over high-speed broadband and higher prices and poorer service for consumers. Companies confronted with Comcast’s bargaining power, like Netflix, are speaking out. And, unusually for an antitrust case, the public is taking notice: 52 percent of Americans in a recent Reuters poll believed that this deal would reduce competition and be bad for consumers….”

Another ‘Too Big to Fail’ Merger From Comcast’s Playbook, Roll Call, April 17, 2014

Click on link above….

NORTHERN CALIFORNIA REAL ESTATE INVESTOR AGREES TO PLEAD GUILTY TO BID RIGGING AND FRAUD AT PUBLIC FORECLOSURE AUCTIONS

WASHINGTON — A Northern California real estate investor has agreed to plead guilty for his role in conspiracies to rig bids and commit mail fraud at public real estate foreclosure auctions in Northern California, the Department of Justice announced.

Felony charges were filed today in the U.S. District Court for the Northern District of California in Oakland against Charles Gonzales, of Alamo, Calif. Including Gonzales, a total of 44 individuals have pleaded guilty or agreed to plead guilty as a result of the department’s ongoing antitrust investigations into bid rigging and fraud at public real estate foreclosure auctions in Northern California.

According to court documents, beginning as early as April 2009 until about October 2010, Gonzales conspired with others not to bid against one another, and instead to designate a winning bidder to obtain selected properties at public real estate foreclosure auctions in Alameda County, Calif. Gonzales was also charged with conspiring to commit mail fraud by fraudulently acquiring title to selected Alameda County properties sold at public auctions and making and receiving payoffs and diverting money to co-conspirators that would have gone to mortgage holders and others by holding second, private auctions open only to members of the conspiracy. The department said that the selected properties were then awarded to the conspirators who submitted the highest bids in the second, private auctions. The private auctions often took place at or near the courthouse steps where the public auctions were held.

“The Antitrust Division’s ongoing investigation has resulted in charges against 44 individuals for their roles in schemes that defraud distressed homeowners and lenders,” said, Bill Baer, Assistant Attorney General in charge of the Department of Justice’s Antitrust Division. “The division will continue to work with its law enforcement partners to vigorously protect competition at the local level.”

The department said that the primary purpose of the conspiracies was to suppress and restrain competition and to conceal payoffs in order to obtain selected real estate offered at Alameda County public foreclosure auctions at non-competitive prices. When real estate properties are sold at the auctions, the proceeds are used to pay off the mortgage and other debt attached to the property, with remaining proceeds, if any, paid to the homeowner. According to court documents, the conspirators paid and received money that otherwise would have gone to pay off the mortgage and other holders of debt secured by the properties, and, in some cases, the defaulting homeowner.

“The symbolism of holding illegitimate and fraudulent private auctions near a courthouse is deplorable,” said David J. Johnson, FBI Special Agent in Charge of the San Francisco Field Office. “The justice system will continue to prevail in this ongoing investigation pursuing bid rigging and fraud at public foreclosure auctions.”

A violation of the Sherman Act carries a maximum penalty of 10 years in prison and a $1 million fine for individuals. The maximum fine for the Sherman Act charges may be increased to twice the gain derived from the crime or twice the loss suffered by the victim if either amount is greater than $1 million. A count of conspiracy to commit mail fraud carries a maximum sentence of 30 years in prison and a $1 million fine. The government can also seek to forfeit the proceeds earned from participating in the conspiracy to commit mail fraud.

Today’s charges are the latest filed by the department in its ongoing investigation into bid rigging and fraud at public real estate foreclosure auctions in San Francisco, San Mateo, Contra Costa and Alameda counties, Calif. These investigations are being conducted by the Antitrust Division’s San Francisco Office and the FBI’s San Francisco Office. Anyone with information concerning bid rigging or fraud related to public real estate foreclosure auctions should contact the Antitrust Division’s San Francisco Office at 415-934-5300, or call the FBI tip line at 415-553-7400.

Today’s charges were brought in connection with the President’s Financial Fraud Enforcement Task Force. The task force was established to wage an aggressive, coordinated and proactive effort to investigate and prosecute financial crimes. With more than 20 federal agencies, 94 U.S. Attorneys’ offices and state and local partners, it is the broadest coalition of law enforcement, investigatory and regulatory agencies ever assembled to combat fraud. Since its formation, the task force has made great strides in facilitating increased investigation and prosecution of financial crimes; enhancing coordination and cooperation among federal, state and local authorities; addressing discrimination in the lending and financial markets and conducting outreach to the public, victims, financial institutions and other organizations. Over the past three fiscal years, the Justice Department has filed nearly 10,000 financial fraud cases against nearly 15,000 defendants, including more than 2,900 mortgage fraud defendants. For more information on the task force, please visit www.StopFraud.gov.

How the FTC’s Hertz Antitrust Fix Went Flat – Professor Maurice Stucke; WSJ.com

How the FTC’s Hertz Antitrust Fix Went Flat

Wall Street Journal

December 8, 2013

Maurice Stucke, a University of Tennessee professor and lawyer with GeyerGorey LLP, said the latest Advantage bankruptcy ought to prompt some soul-searching by the FTC and the Justice Department.

If merger settlements “are going to be business as usual, the agencies need to spend more time examining how their remedies work out over the long haul,” he said. “You would think there could be more safeguards to prevent this from happening.”